You Still Have a Chance to SAVE on Your Student Loans

Student Loan Payments Frozen for Borrowers Set to SAVE

When the Dept. of Education rolled out the SAVE plan last year, it touted a number of benefits that would phase in later, such as a lowered payment formula. In June, federal judges in Kansas and Missouri blocked certain benefits from taking effect. As a result, Federal Student Aid has frozen payments for those borrowers who were enrolled in SAVE while the case is argued in court. The 10th Circuit Court of Appeals, however, reversed the lower court’s ruling and is allowing the Dept. of Ed. to implement all of SAVE while they hear the appeal, but borrowers’ payments will remain frozen as the case continues.

Still Delivering Borrowers a Chance to SAVE

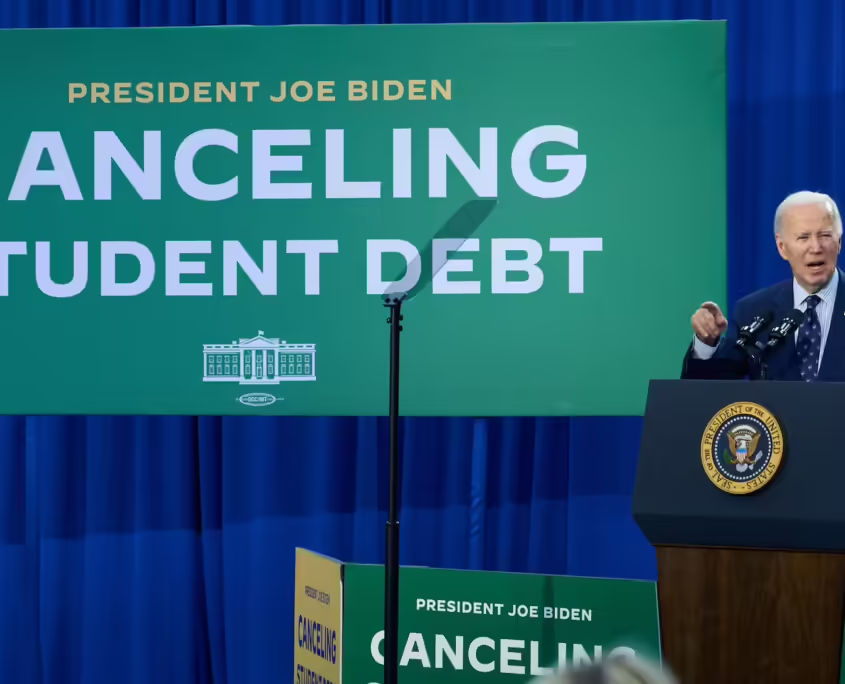

The SAVE plan came about after the Supreme Court struck down Biden’s attempt to effect broad student debt cancellation. The Dept. of Ed. went through the deliberate and painstaking negotiated rulemaking process of updating existing policy, attempting to use previously granted powers for creating income-driven repayment (IDR) plans. One of the plans’ key provisions offers a track to student loan forgiveness after 10 years of repayment for those who borrowed less than $12,000. This provision is similar to the Public Service Loan Forgiveness program, but doesn’t require borrowers to be employed in the public service or not-for-profit sectors. This forgiveness aspect is the only part of SAVE that is being debated in court, as federal judges already ruled that states didn’t have standing to block other portions of the plan.

Those other key parts of SAVE are still in place, which can be difficult to discern from all the media hype. The plan’s ability to lower payments to 5% of a borrower’s discretionary income remains, as does the provision to prevent interest accrual over-and-above a borrower’s monthly payment. In short, this is a battle over one specific element of the SAVE plan, while the rest of it is moving forward while the federal and state governments continue to clash in court.

As attorneys (even high-ranking as they are) continue to bloviate and puff up their achievements in blocking federal policy, be sure to read the fine print. Much of SAVE remains viable and all of it is still in effect; only borrowers with small federal loan balances could be impacted by these rulings.

If you have Federal Student Loans, schedule your free 15-minute Discovery Session to find out if your loans can be forgiven after 25 years.