Student debt cancellation: What’s the hold up?

Student loan cancellation has long been promised, but still no visible progress

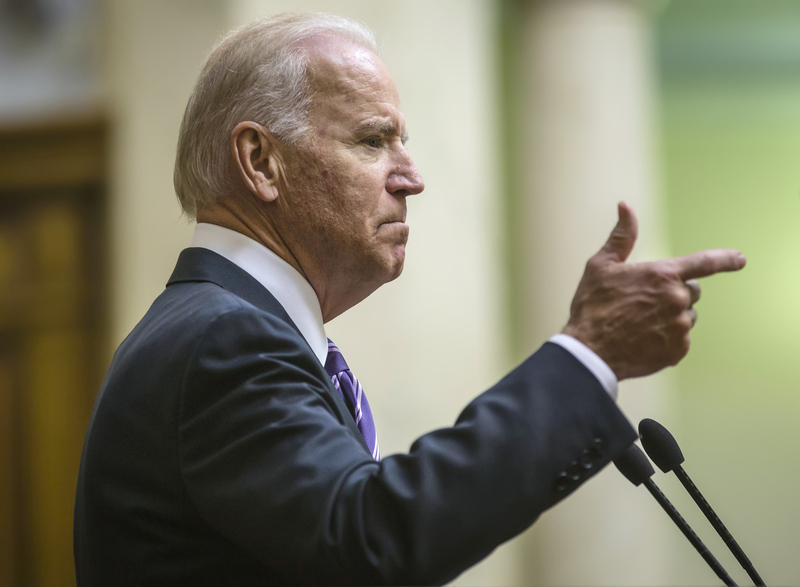

Nine months into Joe Biden’s presidency, most borrowers have yet to see any permanent student debt cancellation, despite a consistent push from his own party, followed by ubiquitous chatter in the media.

While still a candidate, President Biden made it clear that he had the college-affordability crisis in his sights, promising progressive actions like making public universities free for lower-income families, increasing need-based Pell Grants, and reforming and expanding loan forgiveness for public service workers.

When he took office in the midst of the COVID-19 pandemic, President Biden took action to extend the student loan payment and interest moratorium and promised to enact large-scale forgiveness of federal student loans. The latter, however, has yet to materialize and has become a contentious debate among policy-makers, industry experts, and media organizations: all wondering if, when, and how the President will fulfill his promise.

The legal debate surrounding student loan forgiveness

Over the past nine months, two questions have dogged the student debt cancellation conversation: does the President have the authority to forgive student debt without Congress, and—if so—how much should he forgive?

From the beginning, President Biden has been reluctant to act unilaterally, believing that he doesn’t have the power to act since Congress holds “power of the purse.” As a lawyer, former senator, and President of the Senate (as Vice President), one would think he would know.

Other authorities, however, disagree. Senator Elizabeth Warren, for instance—a former Harvard Law Professor and chief author of the Dodd–Frank Wall Street Reform and Consumer Protection Act, which established the CFPB—believes the President does hold the authority to cancel student debt, but the debate rages on. To solve this impasse, the Department of Education has been exploring the legal question since March. In short: either they haven’t come up with an answer, or everyone’s keeping mum.

What should you do in the midst of the debt cancellation debate?

As news outlets continue to harp on the authority question, the real action is happening behind the scenes, leaving borrowers uncertain as to if and when executive student debt forgiveness will ever come. It’s a big issue—one that could have life-changing consequences for millions of Americans—but until a determination is made on executive authority, we simply have to wait.

Fortunately, we have some reassurance that the Biden Administration hasn’t forgotten about borrowers, especially those invested in the embattled Public Service Loan Forgiveness program. The Secretary of Education held hearings back in June, giving experts in the industry an opportunity to weigh in on how to address the student loan crisis; Navigate was among those who testified.

Further, the Department of Ed. gave a three month window for the public to comment on the issue and share their personal stories, an effort which was bolstered by the Student Borrower Protection Center. That period recently ended, and we are waiting to hear the Secretary and President’s response to what they’re heard.

Change is coming: we don’t know how much or when, but we’re confident that it’s around the corner. Be patient, remain calm. When we hear something, you’ll be the first to know.

Over the past nine months, two questions have dogged the student debt cancellation conversation: does the President have the authority to forgive student debt without Congress, and—if so—how much should he forgive?