Spotlight on Student Loans:

Is there too much student debt out there?

Rising College Costs = Too Much Student Debt

How high does the national student loan debt have to grow before loan servicers think it’s too high? Is there too much student debt out there? Nelnet CEO Jeff Noordhoek says it’s too high right now.

At $1.7 trillion, the national balance of student loans is at record-breaking levels, more than five times larger than it was twenty years ago. While Democrats and Republicans continue to argue over whether President Biden can or should cancel $10-50k in student loans, the runaway growth of college cost largely remains absent from the conversation.

Regardless of whether Biden forgives any amount of student debt now, Noordhoek points out that students can expect to borrow another $160 billion next year. In short, student debt will remain an issue unless something is done to make higher education more affordable.

Rising College Costs, Stagnating Wages, and Debt

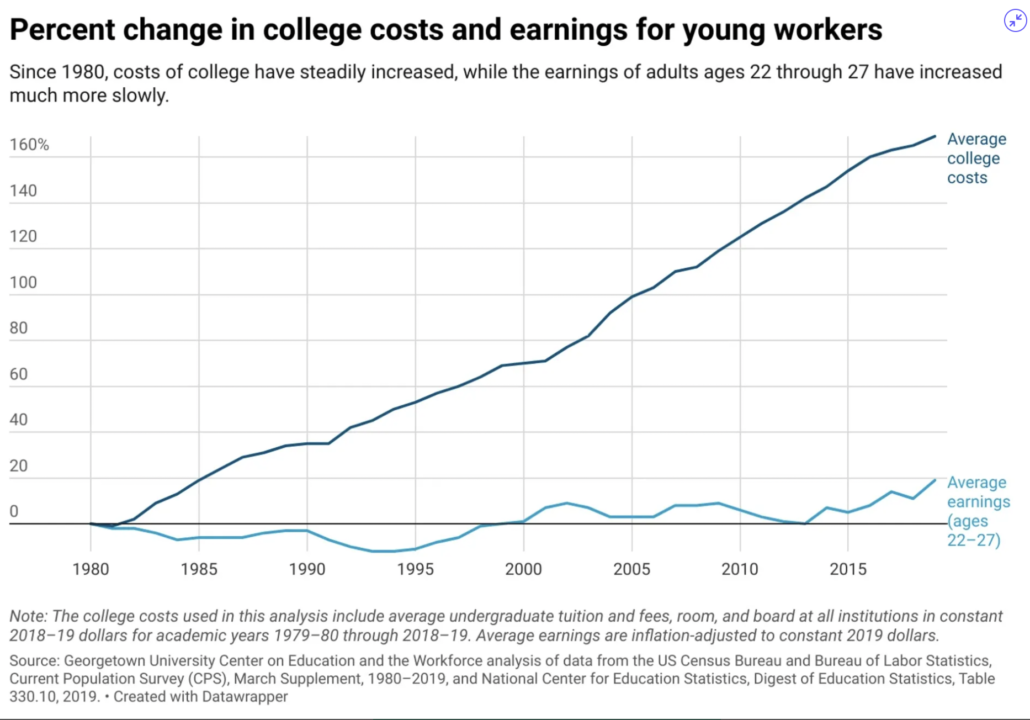

One factor that has contributed to the dramatic increase in student loan borrowing is the growing disparity in the cost of college vs. wages. Georgetown University released a report last year detailing the changes in college tuition & fees and worker salaries; the results aren’t pretty.

Others who have analyzed accelerating college costs have identified a number of factors driving the crisis. Among them are the increasing numbers of students attending college, state government cuts to higher education funding, and the fact that colleges feel like they can charge more because of federal student aid.

Student Loan Borrowers Caught in the Middle

Unfortunately, while politicians, colleges, lenders, and servicers continue to argue about a solution to this crisis, students, borrowers, and workers are caught in the crossfire. If you’re unsure how to manage your own student debt, and don’t see a solution in sight, consult your student loan professionals.

We can help you find a path forward so you don’t have to wait for Washington to take action.

If you’re pursuing Public Service Loan Forgiveness and you haven’t met with us yet, schedule your free 15-minute Discovery Session to find out if you qualify for PSLF, or what you can do if you don’t.